Setting up the Import VAT Reverse Charge

This guide will show you how to setup the text to show on invoices and Tax code setup so that the charges show correctly on your VAT return.

Setting up the Tax code

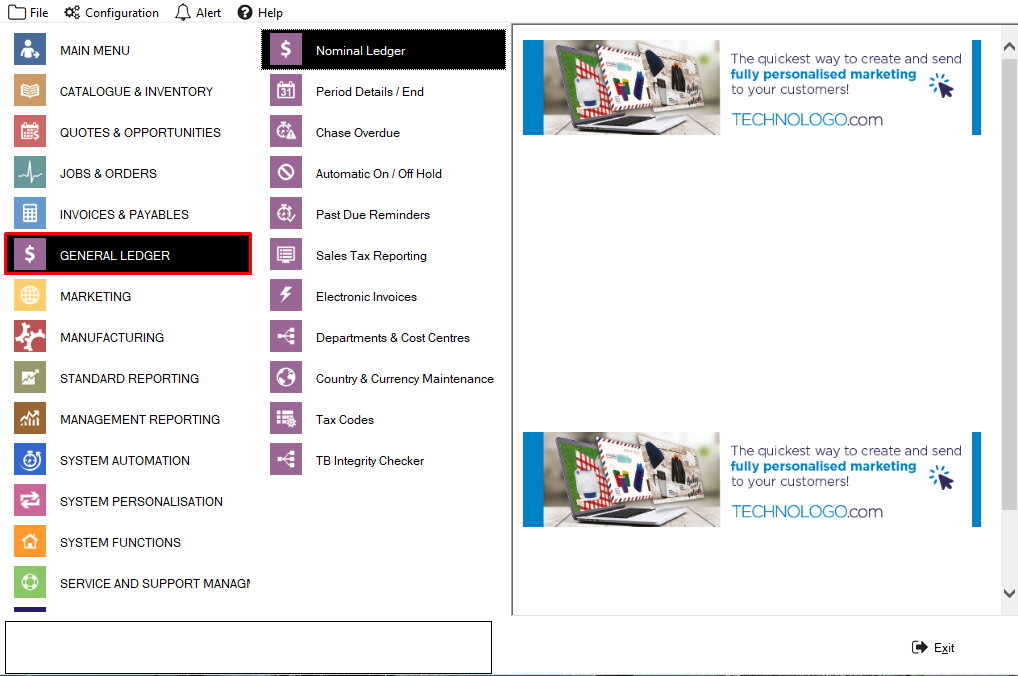

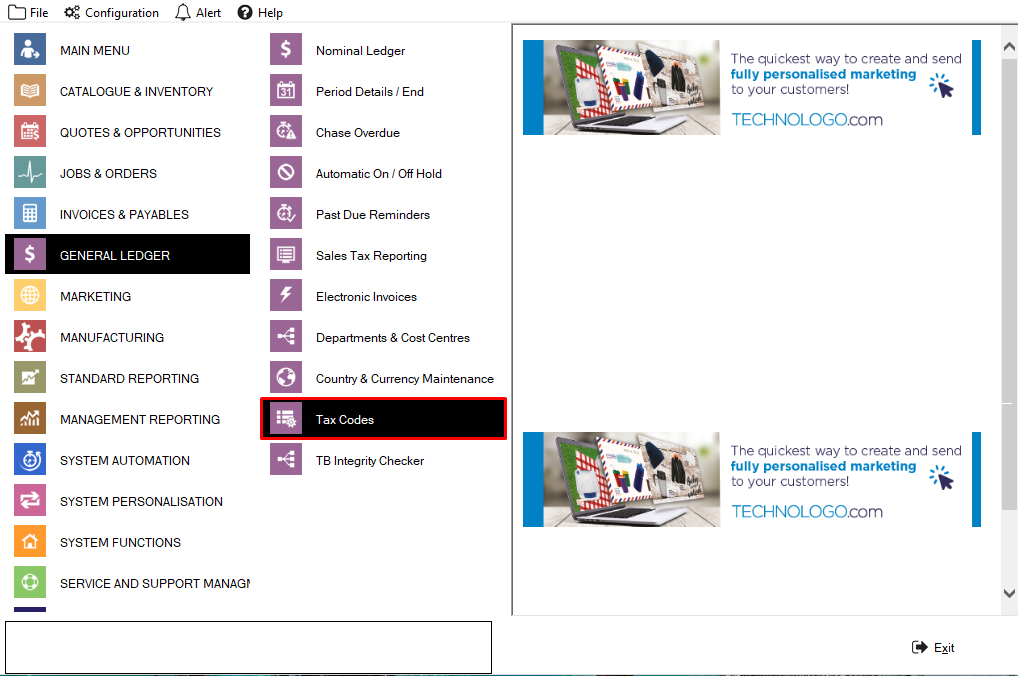

1. Go to the general ledger

2. Click into the tax codes section

3. Edit or add a new tax code for your reverse charge

.png)

4. Once in your tax code you will see an option for “Import Reverse Charge” make sure this is selected. Then enter a taxable reverse code (this will make sure the tax displays correctly on your retrun)

.png)

5. Once happy click the flag to save

.png)

Setting up the invoice text to auto add

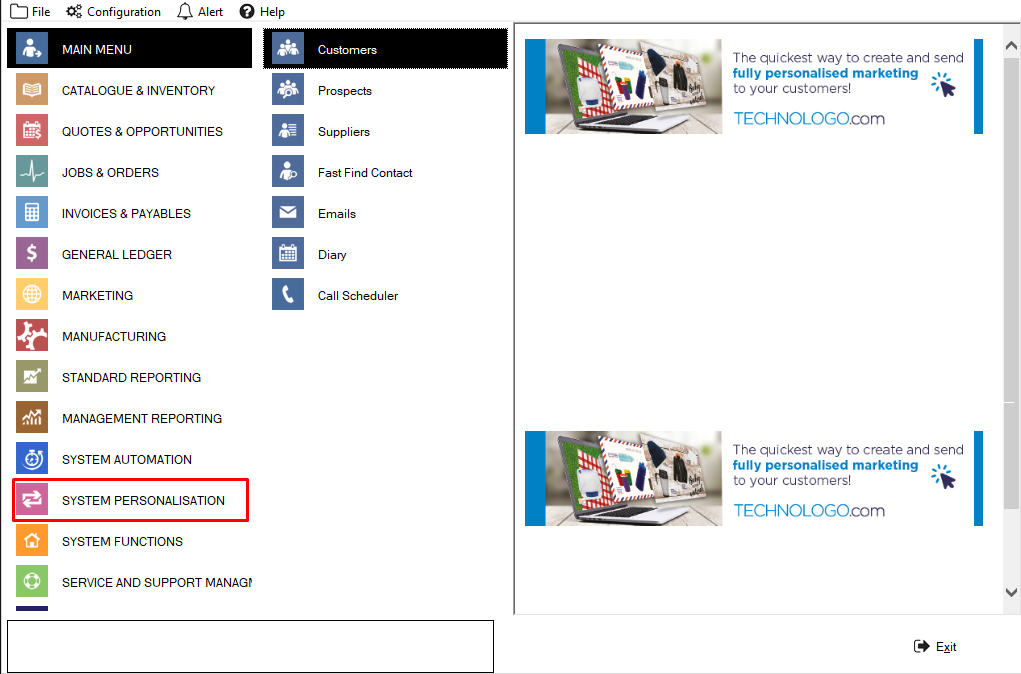

1. Click on system personalisation

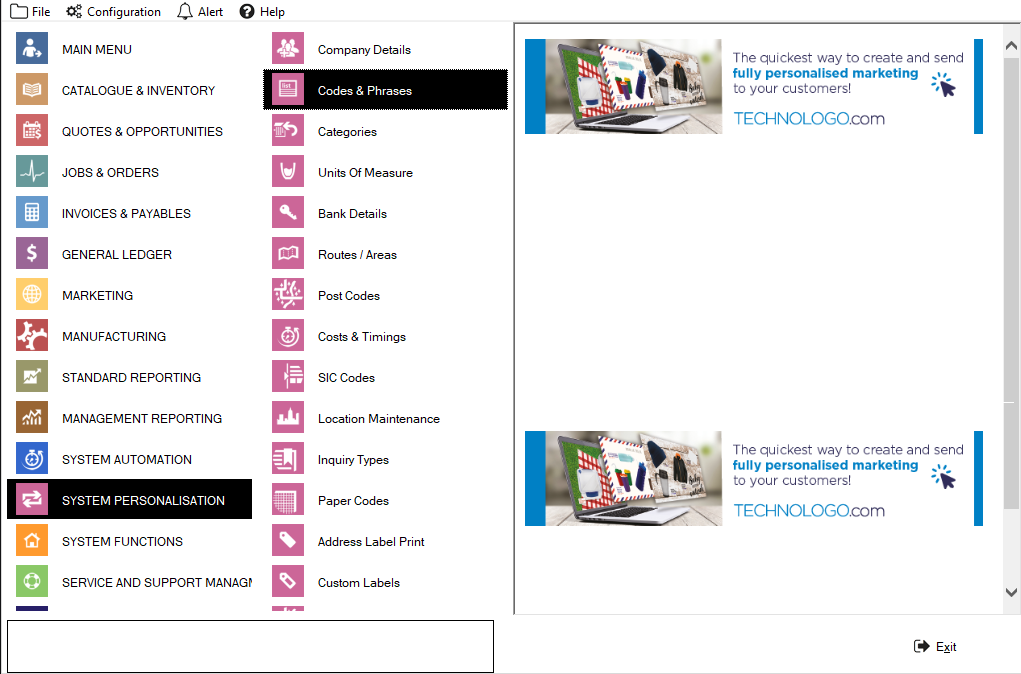

2. Click into codes and phrases

3. At this stage you will need to add two options

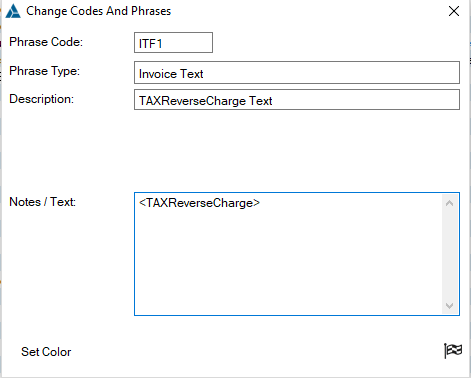

4. The first will have the following information:

Phrase code: ITF1

Phrase type: Invoice text

Description: TAXReverseCharge Text

Notes / text:

It should look like this:

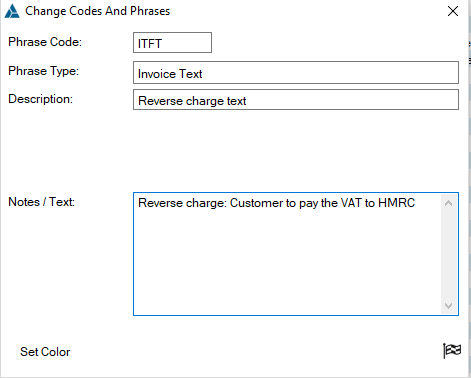

5. The second entry will need the following information:

Phrase code: ITFT

Phrase type: Invoice text

Description: Reverse charge text

Notes / text: Reverse charge: Customer to pay the VAT to HMRC

It should look like this:

Please note your PromoServe will need the post 08/04/2021 upgrade for the above to work correctly.