Making Tax Digital

This is a guide on how to use 'Making Tax Digital' function in Enterprise.

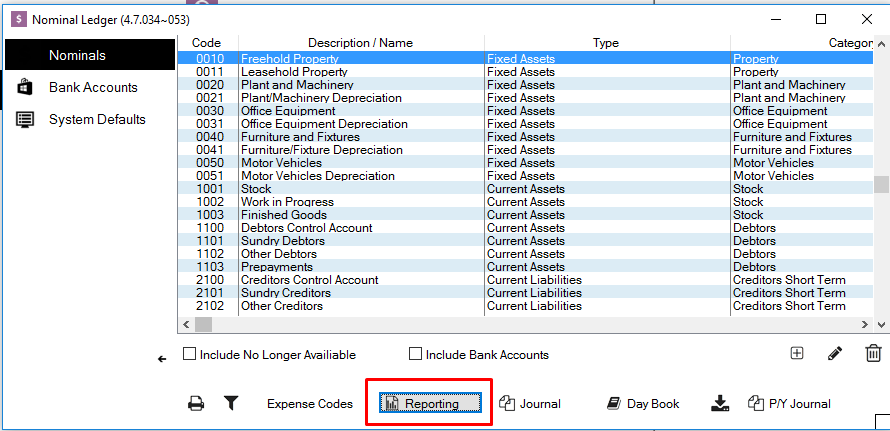

STEP 1

Go to Nominal Ledger – Reporting.

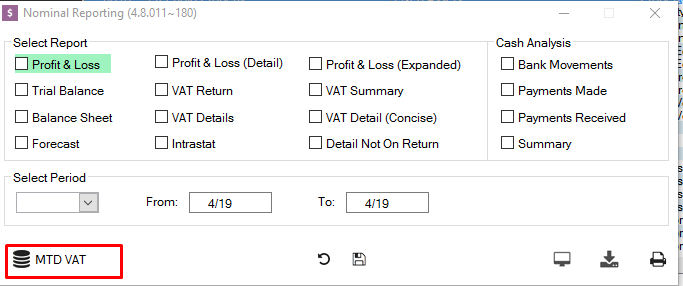

STEP 2

In the nominal reporting screen there is a new MTD VAT button. This is where you would go when you are ready to submit the VAT return to the Government digitally. Click MTD VAT.

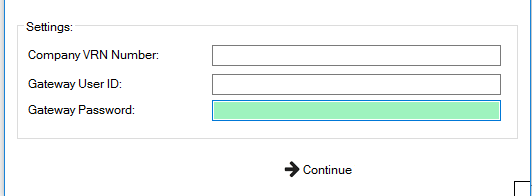

STEP 3

You will then be prompted to enter your Vat Reg Number and your government gateway user Id and password. Enter the required credentials and click continue.

STEP 4

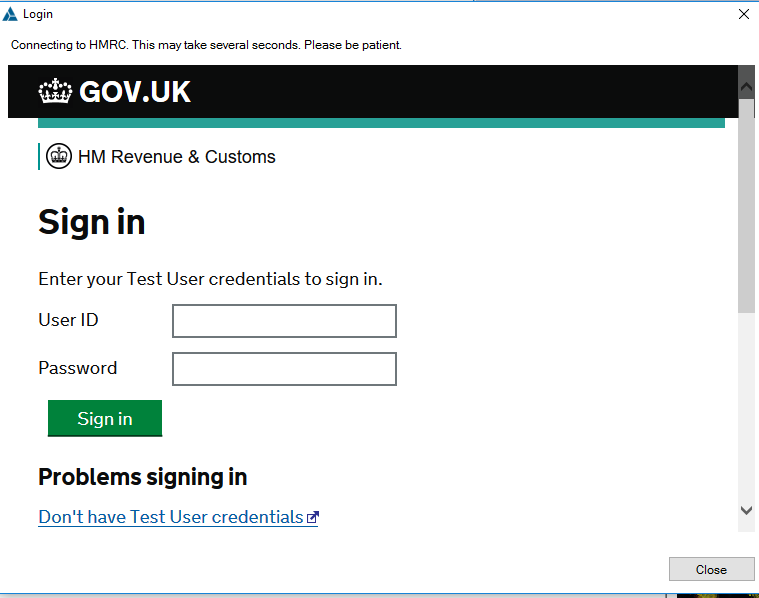

The first time you enter the details and click continue you will be shown the Government MTD website within Promoserve. You will need to click continue and then enter your Government Gateway ID and Password again to connect to the MTD site with your account.

STEP 5

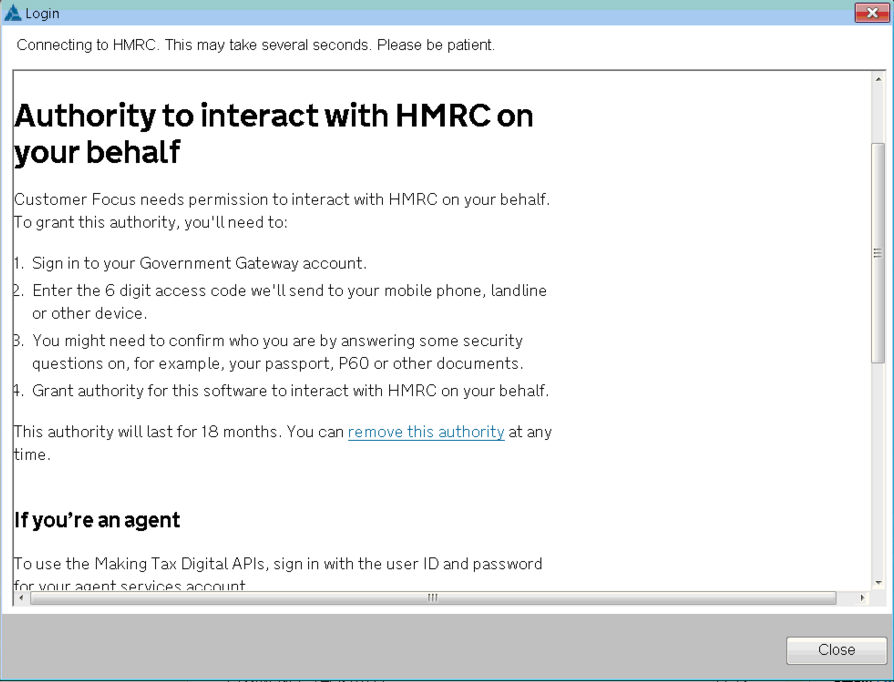

Once you've signed in, you see a page talking about "Authority to interact with HMRC". Close to the bottom there is a section for "If you're an agent". Even though you are not the agent this still applies to you and you'll need to click Continue.

STEP 6

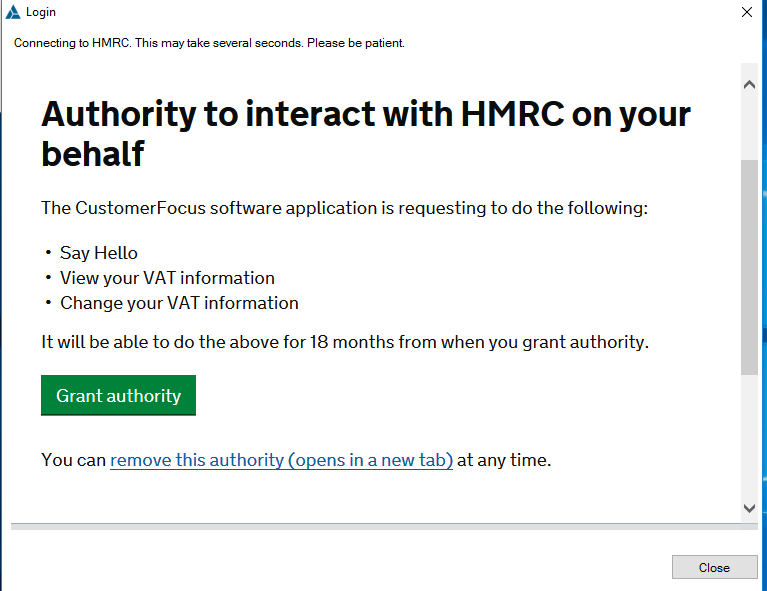

After clicking Continue you will be asked to Grant Authority. You need to ensure you click this.

STEP 7

Once you have granted the authority you will be returned to the windows showing your tax details. You can view Obligations, Liabilities and Payments here. From the obligations screen click the Generate button.

STEP 8

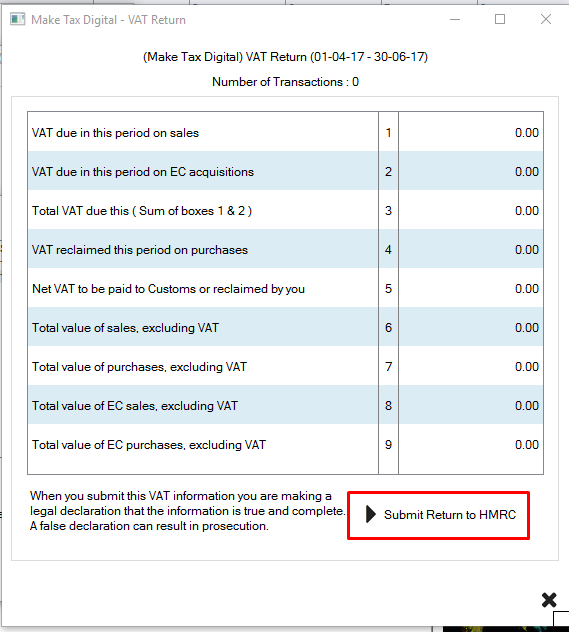

Your current VAT return will be displayed on screen. If you are happy and ready to submit you can then click the Submit Return to HMRC. This will then send your Return electronically to the HMRC Making Tax Digital offices.

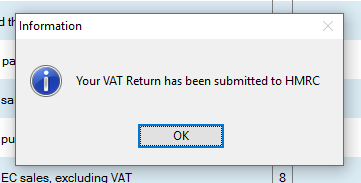

STEP 9

You will then be greeted with the prompt shown to show the submission is succesful.