Tax Rules/Limitations in Customer Focus Order Processing – UK

The 20% VAT rate has been pre-built into Customer Focus Order Processing, so generally you won’t have to worry about modifying tax options within the system. However, as with every rule, there are a few exceptions to this.

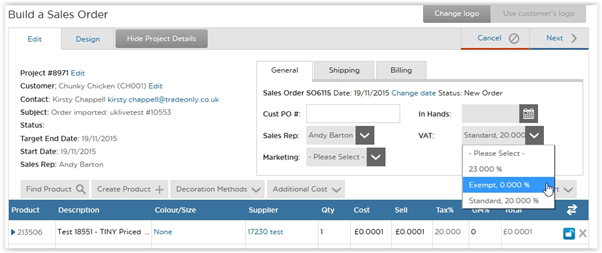

One of these exceptions is international shipping. If you are shipping a product outside of the EU, or within the EU to a customer who is registered for VAT, you should zero the tax on the order. You would do this by selecting the tax exempt option from within a sales order. The option to modify sales tax can be found on the right-hand side of the screen, inside the ‘general’ options tab of the order builder, as shown below:

Additionally, there may be times when shipping to ROI that you would need to apply a 23% VAT rate. This option has also been built into the system should it ever be required.