Year End Procedure

This will show you how to successfully run your Year End within Customer Focus Enterprise.

Preliminary Steps

Before running your Year End, there are a couple of housekeeping measures that must be carried out.

Firstly, it is important to understand that financial documentation such as balance sheets cannot be generated for completely closed years. Therefore, a number of reports must be produced before this point:

- Trial Balance

- Profit & Loss Statement

- Balance Sheet

- VAT Returns

- VAT Details

- VAT Summary

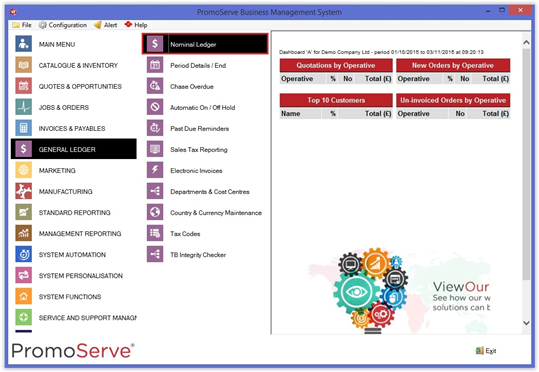

In order to generate these reports, navigate to ‘Nominal Ledger’ within ‘General Ledger’.

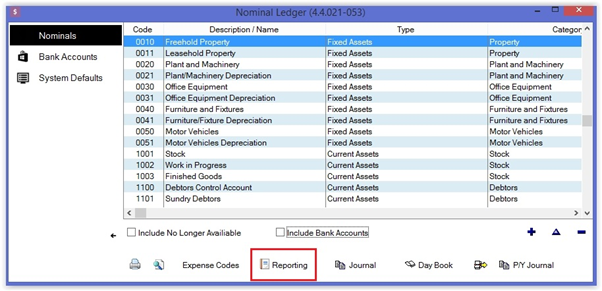

Once there, locate the ‘reporting’ button towards the bottom of the screen

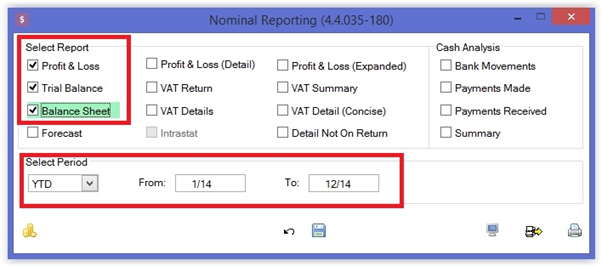

This brings up the reporting options box. In here, ensure that the required reports are selected (as highlighted). You should also ensure that the date range is set to YTD (Year to Date) or if the report is being run late/early, use DR (Date Range) and specify the start of year and end of year.

Once these reports have been run, you can run your Year End.

STEP 1

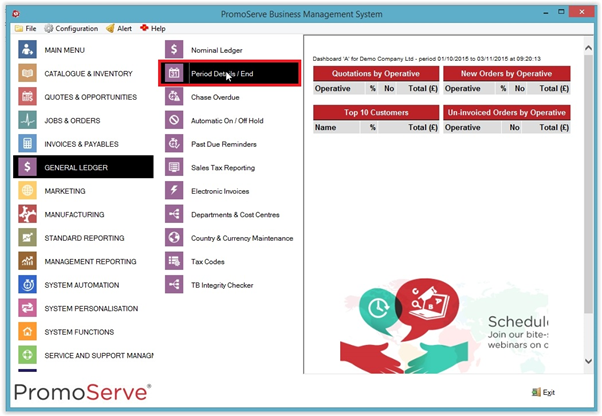

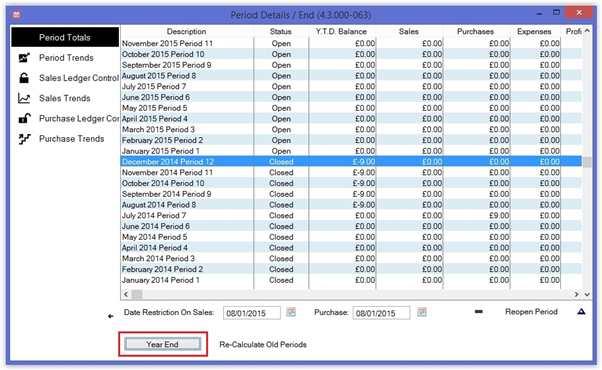

First, navigate to ‘Period Details / End’ under ‘General Ledger’

STEP 2

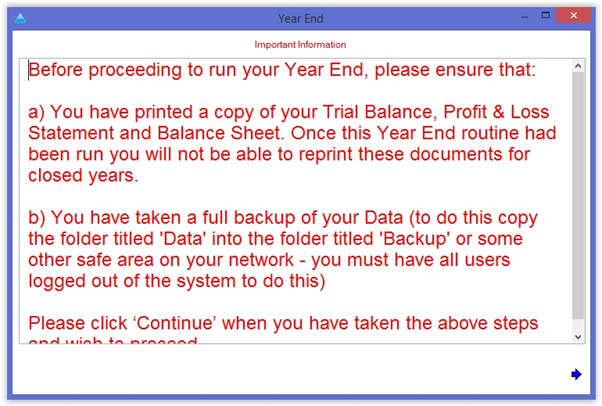

Highlight the December for the current year. Provided the month close has been completed for this month, the Year End option will become available in the bottom-left of the screen. Click this, and you will be greeted with a warning box prompting you to run the reports we mentioned earlier. This provides the last opportunity to double check. To reiterate, once you click continue you cannot generate reports for the year you just closed.

STEP 3

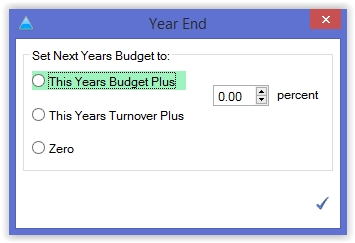

After continuing past the warning, you are presented with a box to define next years budget. You can choose to either base it on this year’s budget/turnover, plus a percentage, or zero it.

Following this, the Year End Procedure has been completed.